Are you looking for the top accounting firms in Melbourne?

But with so many different professionals on the market, it can be not easy trying to find the professional that is simply the best.

To help you get started looking for a business accountant, we’ve created an ultimate list of the top business accountants from right across Melbourne, Victoria.

Melbourne’s Top Business Accountants

Hillyer Riches Business Accountants in Melbourne

(03) 9571 5333

We provide peace of mind for you and your business by delivering taxation, accounting bookkeeping, and advisory services in Caulfield East.

Looking For An Accounting Firm As Agile As Your Business?

Our Caulfield tax and accounting firm includes chartered accountants, tax specialists, business & marketing advisors, financial planners and wealth specialists passionate about your business and personal success.

From BAS/IAS and business/personal tax through to strategies to help grow your business, improve cash flow, enhance profit while protecting assets, and plan for succession. If you're looking for more than just bean counters, then speak with our friendly team of tax and accounting advisors and check out our range of services.

Accounting

Our services include all aspects of tax accounting and planning, pre-30 June reviews, tax cost minimisation strategies, capital gains tax record keeping, BAS and IAS requirements, and cloud bookkeeping services. We will make sure you comply with all statutory requirements at both state and federal levels – it is our job, not yours, to keep up with all the legislation.

EWM Accountants & Business Advisors in Melbourne

ewmaccountants.com.au | oakleighaccountants.com.au

03 9568 5444

EWM Accountants and Business Advisors are Chartered Accountants helping small businesses with their accounting, bookkeeping and taxation needs. Established more than 30 years ago, we are experts in helping small businesses specialise in construction, investment, medical, dental and manufacturing industries. Based on busy Oakleigh in Melbourne, the firm is made up of a group of expert accountants who bring a wealth of experience to help fulfil our vision.

Bookkept - Business Accountants Melbourne

(03) 8568 3606

Bookkept are CPA-qualified accountants and business advisors who provide quality professional accounting & business advice to small & medium business clients.

We take care of small business compliance, bookkeeping & ATO issues. We're specialists on Xero/MYOB & payroll on the accounting side and help with business processes and systems to ensure you have the capacity to grow your revenue.

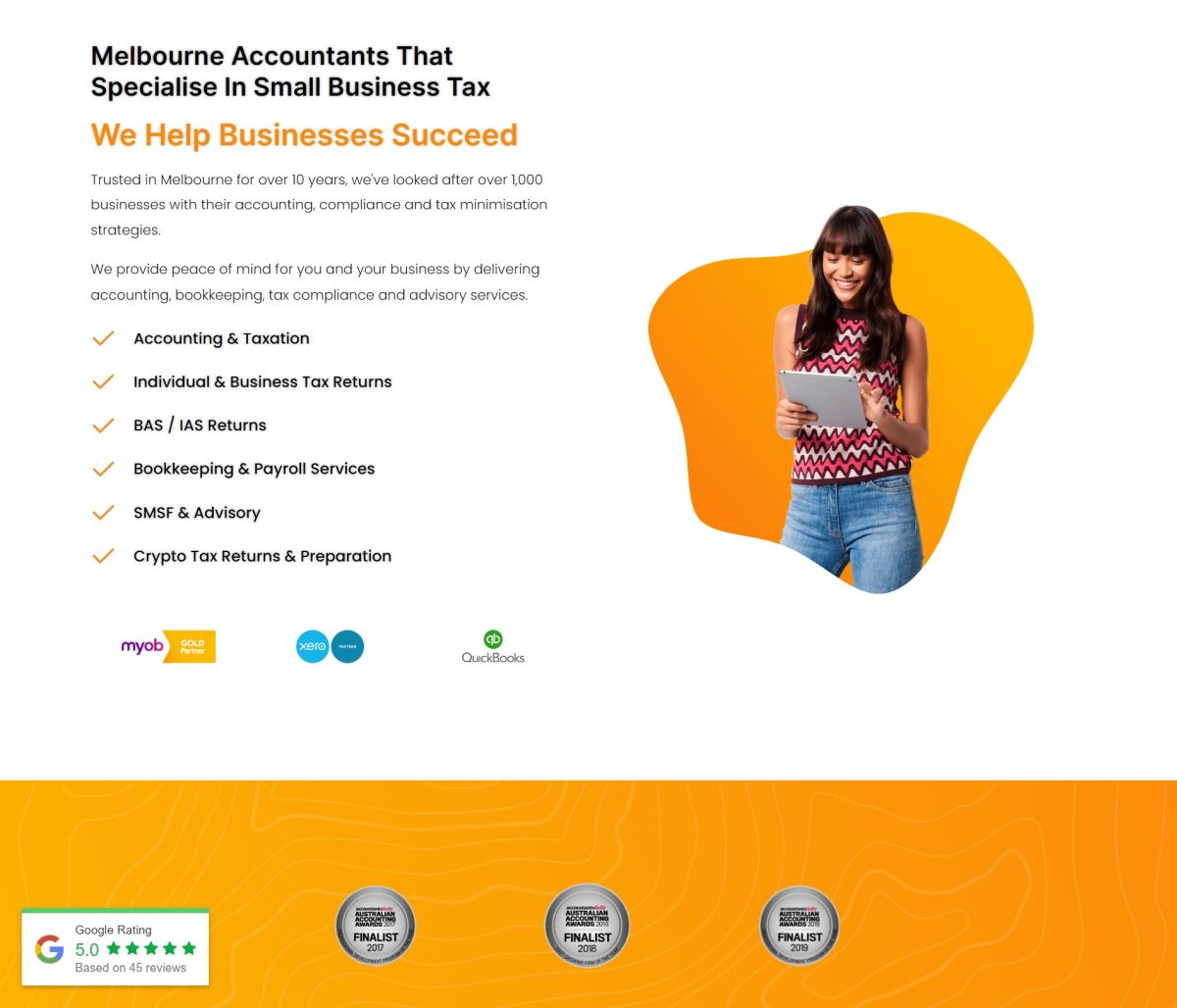

Tax Window - Business Accountants Melbourne

Tax Window, a prominent accounting firm headquartered in Melbourne, is committed to assisting both individuals and businesses in achieving their financial goals. They employ a strategic approach to convert their clients' aspirations into realistic and attainable objectives. With a wealth of 30 years in the field, Tax Window sets itself apart by ensuring that experienced senior accountants, rather than junior counterparts, handle client affairs. The firm takes pride in its transparent pricing model, emphasizing that, though they communicate and think like accountants, their charges diverge from the conventional norms.

Range of Services:

- Accounting Services for Small Businesses

- Tax Agent Services

- Business Advisory

- Guidance on Self-Managed Super Funds (SMSF)

- Investment Planning

- Property Consultation

- Services that are tailored to many different types of businesses, including trades, new businesses, buildings, medical practises, restaurants, plumbing systems, cafes, bars, and franchising.

Contact Details:

Website: https://www.taxwindow.com.au/

Address: Level 1/441 South Rd, Bentleigh VIC 3204

Operating Hours: Mon-Sun 9:00-18:00 (By Appointment)

Phone: 03 9999 8538

Email: info@taxwindow.com.au

KPG Taxation - Business Accountants Melbourne

03 9706 9318

WELCOME TO KPG TAXATION!

Do you need competent accountants in Dandenong? Do you intend to submit your tax returns? If so, KPG Taxation is available to help. Due to our extensive industry knowledge, we are able to provide accounting, bookkeeping, and tax services that are accurate and timely. We are able to go above and beyond client expectations because of our passion and attention to efficiency.

Our group, which is headed by Parampreet Singh Rajput, is made up of seasoned accountants and tax consultants that are adept at serving a range of Melbourne enterprises, professionals, and small public practice firms.

For all of your accounting and tax needs in Melbourne, KPG Taxation is the company to contact. By offering effective bookkeeping, payroll management, and tax counselling services to individuals and businesses over time, we have been able to gain the trust of our clients and a solid name in the market.

Hughes O’Dea Corredig - Best Business Accountants Melbourne

03 9375 4289

We offer a dedication to accuracy and integrity to protect your financial interests at Hughes O'Dea Corredig because we are experts in a broad range of financial advisory, accounting, taxes, and auditing services. As a top accounting firm in Melbourne, we assist you in navigating the maze of financial taxes and legislation so that you can come to wise judgments regarding your short- and long-term financial planning (personal taxes) as well as that of your company.

Business Advisory Services Melbourne

Through our company advising services in Melbourne, our qualified tax specialists deliver precise and insightful financial information so you can retain profitability and take advantage of new opportunities. We can assist you in achieving your objectives by providing precise record keeping, reporting, and specifically designed financial support.

The resources needed to value businesses are always expanding. Our specialists can confidently direct you toward business decisions with the use of our data-backed business consulting services in Melbourne, which can give in-depth analysis to uncover the elements that increase the worth of your company.

M.A.S. Partners - Best Business Accountants Melbourne

(03) 8866 1556

WELCOME TO M.A.S PARTNERS

M.A.S Partners (previously m.a.s accountants), Australia's first accounting firm for small businesses, has been offering accounting and advice services to Sydney, Melbourne, and Australian small enterprises for more than 55 years.

Our accounting services let our clients concentrate on growing their businesses thanks to our locations in Melbourne and Sydney and our dedicated staff of small business accountants and advisors. Business accounting is our forte. We have experience working with a wide range of clients who all have various demands, from the fundamentals of accounting to tax accounting or payroll administration, accounts payable and accounts receivable support.

Doctors, dentists, construction firms, restaurants, investors, independent contractors in trades, pharmacies, retail stores, marketing consultants, architects, interior designers, solicitors, and a wide range of other professionals and enterprises make up our clientele. We've been around since 1961, we're the original. The demands placed on small firms in terms of accounting and advising services have changed significantly during the last 58 years. We have changed and evolved during this time, always placing our customers at the centre of all we do.

Melbourne Accounting Partners

(03) 9654 8587

Welcome to Melbourne Accounting Partners

In the centre of the CBD, Melbourne Accounting Partners is a proactive and forward-thinking business. We pride ourselves on our commitment to our clients as both business advisors and business partners, and we offer solutions to maximize the performance and growth of your company.

We are confident that the firm's team's guidance and experience can help you resolve any problems you may experience with your company's operations. assisting people and businesses to file taxes and save money. measurement, processing, and sharing of financial data about firms and other economic entities.

Reporting and analysis of the general goods and services tax. Help and support in managing your super fund to meet your retirement goals financially. Analyzing past business performance and providing suggestions and tactics to help your company get the outcomes you want. identifying and creating strategies for business future planning.

Opulent Accountants - Business Accountants Melbourne

03 8838 8728

For all of our clients, whether they are small, medium-sized, or large, Opulent Accountants is designed to assist develop, maximising, and projectinging wealth. We are set up to assist all of our clients in creating, maximizing, and projecting wealth. Our reputation has always placed a priority on providing individualized care and professionalism, which has been the foundation of our success.

Tax Agent

Are tax-related issues giving you trouble? Without a doubt, your team does not include the proper tax agent. The right tax advisor will spare you from a lot of depleting roadblocks. Many of us receive falsified tax records and fraudulent tax returns, which is sufficient cause for us to lie in bed all night worrying. The appropriate tax agent follows. Your tax returns are properly filed by someone whose accounting license is worth it and wouldn't choke you with their overhead expenses. We are aware that the government closely monitors tax collection in Melbourne, particularly in Mt. Waverly and Glen Waverly, two of Australia's major economic hubs.

Since a thorough tax audit is always possible in a society where financial transparency is revered, tax agents in Melbourne are currently tremendously in-demand. When the need arises, the appropriate papers and documentation should be available. Given that both can easily fill the role of a financial adviser, the necessity for business tax agents in Melbourne may also be linked to the requirement for a business agent.

Bottrell Business Consultants - Business Accountants Melbourne

02 4027 5380

For today's corporate environment, Bottrell Business Consultants is dedicated to providing a whole spectrum of accounting, taxation, and business services. We have a wealth of expertise in helping clients achieve both their professional and personal objectives. The business world of today is always evolving, and we can make sure you don't fall behind.

ACCOUNTING & TAXATION

The Bottrell team is a group of persons and firms that specializes in accounting and tax for super funds. To guarantee that objectives are met, we provide our clients with support and develop plans on a personal and professional level. The Bottrell team has experts ready to assist, whether you just need help with a personal tax return or you're a corporation seeking for BAS support.

Our professional business advice background includes significant managerial experience in the sizable manufacturing, shipbuilding, and marine industries as well as sizable professional accounting, tax, and business consulting businesses. For our SME (Small to Medium-Sized) and Large Company clients, we fill a critical financial controller position while assisting them with all of their unique accounting, taxation, and business needs.

Big car dealerships, big engineering, attorneys, financial planners, insurance agents, mortgage agents, physicians, nurses, and other health care providers, as well as fitness centres, bars, restaurants, hotels, Domino franchises, Boost Juice franchises, retailers, haulage, property developers, builders, earthmoving & civil, and all associated building supporting industries, make up the majority of our expanding clientele.

South Melbourne Accounting - Business Accountants Melbourne

Welcome to South Melbourne Accounting

The innovative accounting firm South Melbourne Accounting (SMACC) is conveniently situated in South Melbourne next to the Domain Interchange. Conveniently, the City is right outside our front door. Our team is dedicated to providing you with personalized and high-quality service, and we offer a variety of boutique accounting and taxation services as varied as our clientele.

By identifying the untapped potential in your company, we develop and put into practice solutions to increase your cash flow. By appointment, our team can accommodate after-hours meetings and is courteous and knowledgable. The Practice was founded by Noel Lockett and has had a long-standing South Melbourne location. Noel has a wide range of professional expertise working with organizations, individuals, and professionals.

Our services, which include tax planning and guidance for individuals and small businesses, are our area of expertise. Our clientele comes from a wide range of industries and professions, including those related to law, medicine, dentistry, inventors, cleaning services, real estate development, franchisees, pilots, truck driving, sales, and computer technology.

BuildGrowth Accountants - Business Accountants Melbourne

(03) 9028 8156

Get back to the things you love

You may free up your time to focus on the things you truly enjoy doing by outsourcing your Accounting and Tax responsibilities to our knowledgeable consultants at BuildGrowth Accountants. You can track the data you need to measure and put effective productivity and profit improvement initiatives into practice with the aid of our Melbourne-based team of accountants.

Recruitment and Staffing Accountants Australia

We at BuildGrowth Accountants are aware that for business owners, accounting and tax issues can be the stuff of nightmares. However, we like assisting business owners in time and money savings as well as compliance, which is why we provide complete accounting and tax solutions.

Accounting

We, accountants, recognize the value of reliable accounting systems and precise financial data. You won't have the knowledge and insights required to make wise judgments without these in place. Simply put, you would be driving blind. One of the factors in our decision to employ cloud accounting is this. You may access current, accurate, and relevant business data using cloud accounting software programs like Xero from any location with Internet connectivity. As your advisors, this enables us to provide you with better advice utilizing current financial data. We can create budgets, projections, reports, and strategic analyses with reliable information.

BH Accounting - Business Accountants Melbourne

03 9600 9029

Your Friendly Tax Guy

No matter what type of structure your business operates under, BH Accounting Solutions have the experience and expertise to make sense of your accounts. We specialize in helping individuals, small enterprises, and major corporations set up and maintain their financial records.

We are aware that life is more than just completing paperwork or studying spreadsheets. We strive to make tax returns and financial planning for you as quick, convenient, and understandable as we can. You can lower operational costs, sharpen business focus, and boost output by contracting BH Accounting to handle your accounting needs.

Business Services Melbourne

Small-business ownership comes with its own special set of advantages and challenges. Because we are a Melbourne small business services, we specialize in providing services to small businesses. Our role is to help you navigate tax legislation, not just to ensure you comply but to make sure your affairs are structured in the most effective way to avoid significant and unnecessary taxation liabilities.

UTAX Accountants - Business Accountants Melbourne

(03) 9569 6913

We are a small business that cares for its clients and always puts "U" first. Welcome to UTAX Accountants, where "our emphasis is U." We are a Melbourne-based staff that is warm and approachable. Our office staff members are highly skilled specialists who will help you from start to finish.

We individually follow up on requests to provide solutions that are unique to you or your company's requirements. You can choose from a number of services that UTAX can provide for Individuals, Businesses, Trusts, and Self-Managed Superannuation Funds. You can get continuing help from our specialized bookkeeping services while you navigate the obligations of managing a business.

UTAX Accountants are here to assist you in achieving your goals, no matter what they may be. We provide you with our whole attention while taking the time to comprehend your financial situation. Because "U" deserve nothing less.

Accounts NextGen - Business Accountants Melbourne

(03) 9015 8549

We can manage your tax return and accounting all under one roof

One of Melbourne's CBD's most reputable tax accounting firms is Accounts NextGen. Thousands of our customers received our assistance in claiming the greatest amount of tax. Our knowledgeable staff of seasoned accountants is committed to offering clients high-quality services that are hassle-free. We strive to offer a quick and substantial tax refund in only 7 days, all while keeping costs low.

Our Services

With our top-notch tools and processes, we aim to provide businesses with a full variety of accounting services that are affordable, dependable, and quick. Our accounting training-related programs are specially made to assist people in developing vital abilities and expertise in the field for an improved profession. We are committed to assisting people in need and providing a helping hand in the form of complete loan assistance and services.

Our expertly trained specialists can provide accurate and dependable accounting services throughout Melbourne thanks to streamlined processes and strong infrastructure. With our cost-effective IT solutions, we manage your infrastructure with great care in order to advance your company. With our decades of expertise, competitive global payments, and currency services, we provide a smart approach to managing your foreign exchange.

The Co. Accountants - Business Accountants Melbourne

03 8488 9801

With over a decade of experience providing expert financial advice.

With more than 22 years of combined industry expertise and a Melbourne base, we are pioneering providers of comprehensive accounting and business advising solutions. Along with our strong financial and accounting backgrounds, we provide a wide selection of highly customizable financial advice and solutions based on dependability, effectiveness, and thorough research. We are here to maximize the chances of success for your company!

To provide you with customized solutions that are most suited for your business model and your budget, we additionally engage the efficient services of our financial brokers and planners, as well as legal consultants. Experienced director Peter Mercuri is in charge. Peter has a wide range of skills and is knowledgeable about both the functional dynamics of businesses and the complexities of the accounting industry.

Peter and the team at The Co. have provided exceptional accounting services and business guidance for more than ten years. Our carefully handled financial services serve a variety of professional service-based sectors, as well as smaller and larger businesses. Our services have benefitted many different businesses, including those in building and construction, food and processing, mining, manufacturing, medicine, and high-net-worth individuals.

K Partners - Business Accountants Melbourne

03 9863 8856

Melbourne-based Accountants & Financial Planners

Our accountants are here to assist you in expanding your business and personal finances. For more than 10 years, our Melbourne-based boutique advisory accounting firm has provided accounting, financial guidance, mortgage and life insurance assistance, and SMSF to help individuals and businesses succeed.

Accounting & Tax

If you own a small business or operate your own company in Melbourne, you need an accountant who is aware of the opportunities and difficulties brought on by shifting economic conditions. With our committed tax consultants and accountants for small businesses on your side, managing your tax accounts is easy and efficient. We are prepared to help you with your accounting needs and have extensive knowledge of a variety of small businesses, including those in hospitality, farming, trades, medical, IT, and transportation. You will receive the appropriate guidance you require from our small business accountants, advisors, and mentors. We are well-equipped to assist you with your wealth-building, tax, and compliance initiatives.

Business Advisory

We have assisted countless small businesses in streamlining their operations and setting and achieving financial objectives. The CPAs on our staff recognize that you have a small business to manage, clients to satisfy, and goods to perfect. You may feel comforted knowing the accountants at K Partners will build a plan and provide guidance that enhances your bottom line.